massachusetts estate tax rates table

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Certain capital gains are taxed at 12.

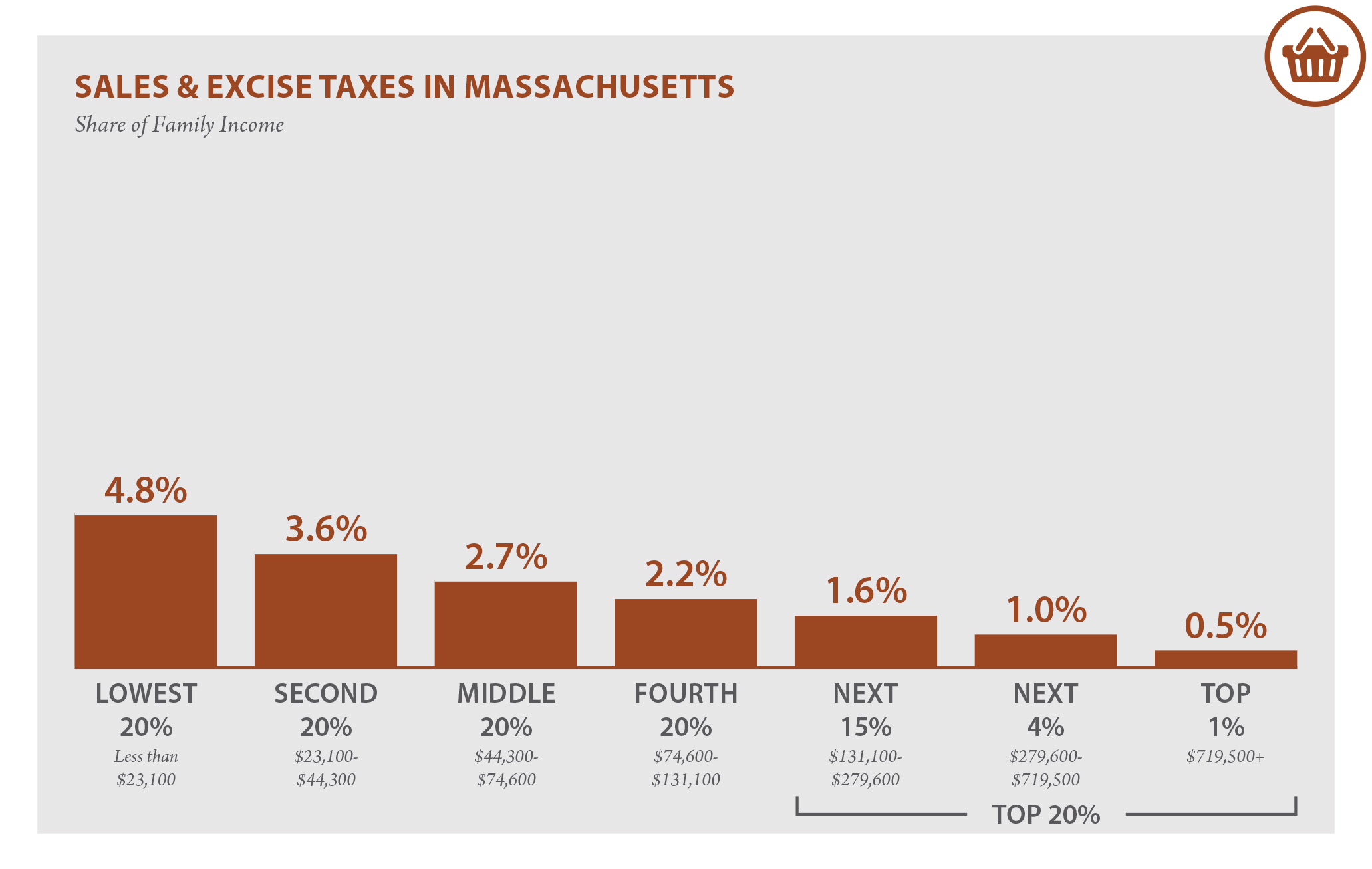

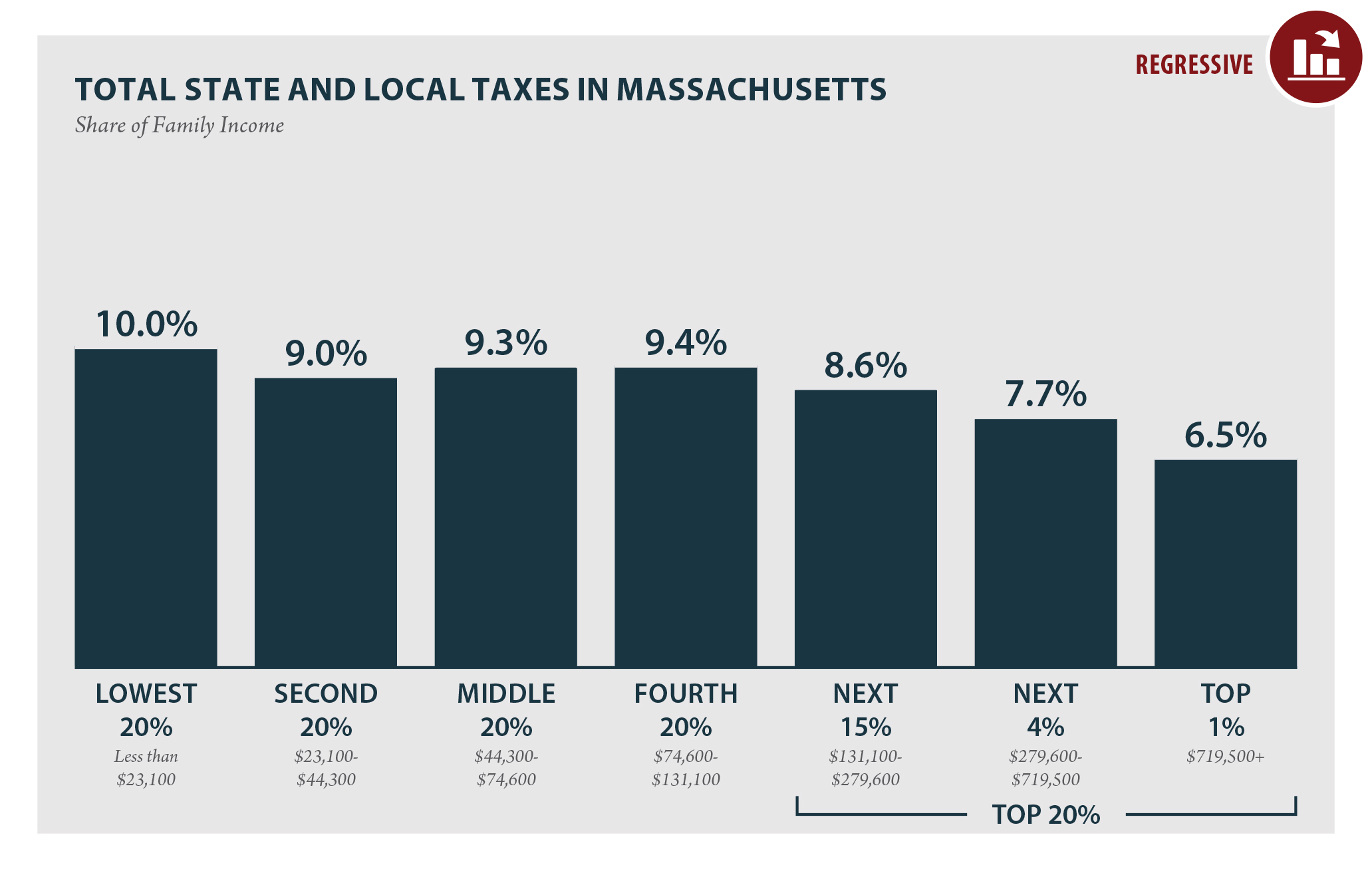

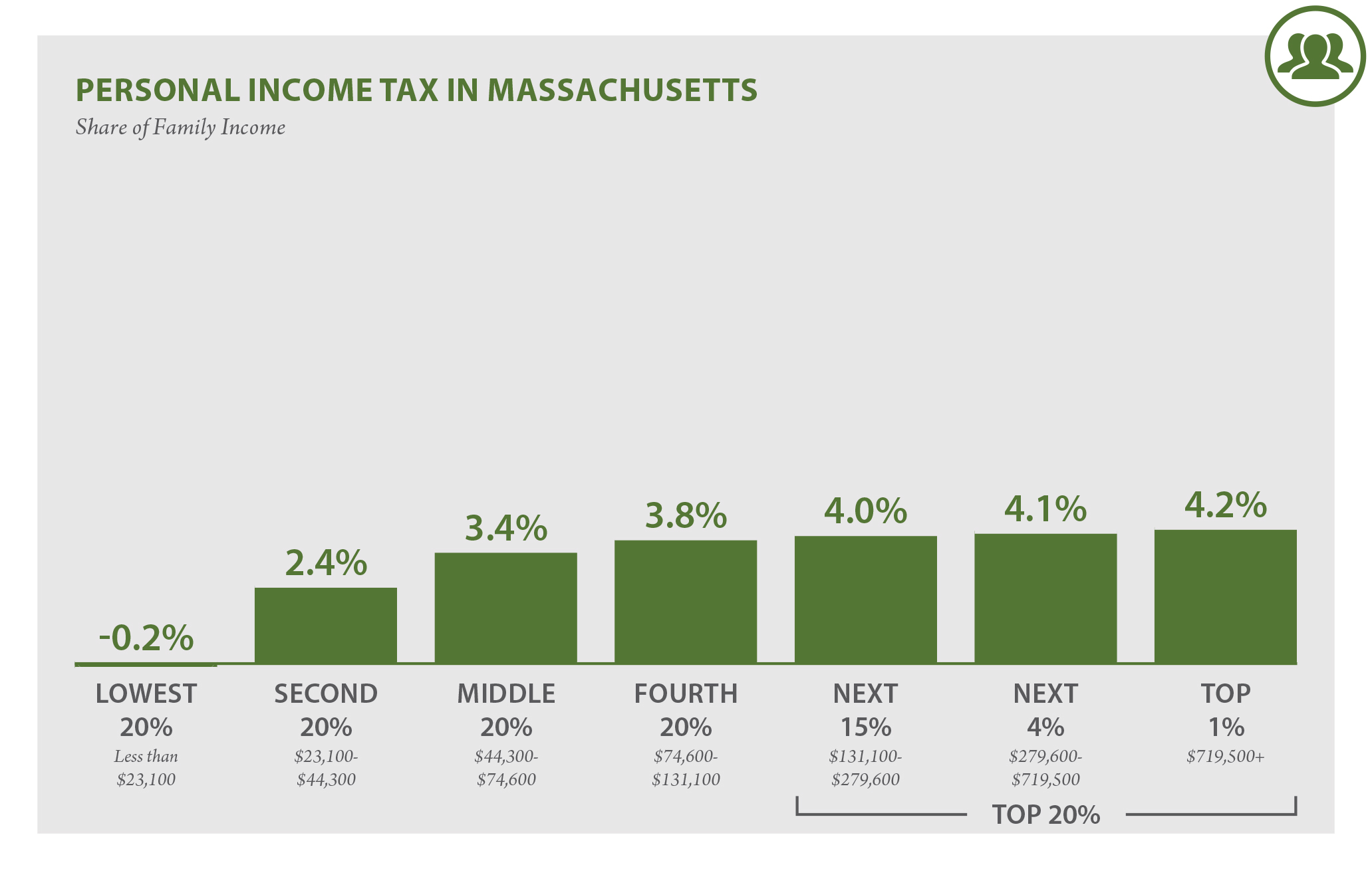

Massachusetts Who Pays 6th Edition Itep

If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16.

. In this example 400000 is in excess of 1040000 1440000 less 1040000. To figure out how much your estate will need to pay in estate taxes first find your taxable estate bracket in the chart below. Acton MA Sales Tax Rate.

Your estate will only attract the 0 tax rate if its valued at 40000 and below. Acushnet MA Sales Tax Rate. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes.

If youre responsible for the estate of someone who has died you may need to file an estate tax return. Print This Table Next Table starting at 4780 Price Tax. Using the table this tax is calculated as follows.

Agawam MA Sales Tax Rate. Provide accurate and useful information and latest news about Massachusetts Estate Tax Rate Table instruct patients to use medicine and medical equipment and technology correctly in order to protect their health. The table below lists all of the rates.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect on December 31 2000 exceeds 1000000. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional. The maximum credit for state death taxes is 64400 38800 plus 25600.

The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax. Allston MA Sales Tax Rate. Abington MA Sales Tax Rate.

Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. 50 personal income tax rate for tax year 2021. Massachusetts Sales Tax Table at 625 - Prices from 100 to 4780.

Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. 22 rows Massachusetts Estate Tax Rates. A properly crafted estate plan may.

5000000 - 60000 4940000. Massachusetts has one of the highest average property tax rates in the country with only five states levying higher. The state sales tax rate in massachusetts is 625 but you can customize this table as.

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax Includes information and forms. Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return.

If youre responsible for the estate of someone who has died you may need to file an estate tax return. Up to 100 - annual filing. If youre wondering what.

For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest dividends and capital gains income. The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. Accord MA Sales Tax Rate.

In the second column youll see the base taxes owed on wealth that falls below your bracket. Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600. 17 rows Tax year 2021 Withholding.

Tax amount varies by county. Adams MA Sales Tax Rate. Massachusetts Municipal Property Taxes.

Everyone whose Massachusetts gross income is 8000 or more must file a Massachusetts personal. An estate valued at 1 million will pay about 36500. The credit on 400000 is 25600 400000 064.

Acushnet Center MA Sales Tax Rate. The estate tax rate for Massachusetts is graduated. The top estate tax rate is 16 percent exemption threshold.

Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states. Alford MA Sales Tax Rate. The Department of Revenue DOR does not and cannot administer advocate or adjudicate municipal taxpayer issues.

For the most up to date tax rates please visit the Commonwealth of Massachusetts. 352 rows Property tax rates are also referred to as property mill rates. For many cities and towns property taxes are the largest funding source for teachers police firefighters public works like trash pick-up and many other local resources and services.

A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16. Total Sales Tax Rate.

Massachusetts Estate Tax Rate.

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

Massachusetts Who Pays 6th Edition Itep

Massachusetts Estate Tax Everything You Need To Know Smartasset

2022 Tax Inflation Adjustments Released By Irs

Massachusetts Estate Tax Everything You Need To Know Smartasset

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust