does the dave app really give you money

Tipping is optional but encouraged. The app does not require a credit check and it also.

Dave is the finance version of David vs.

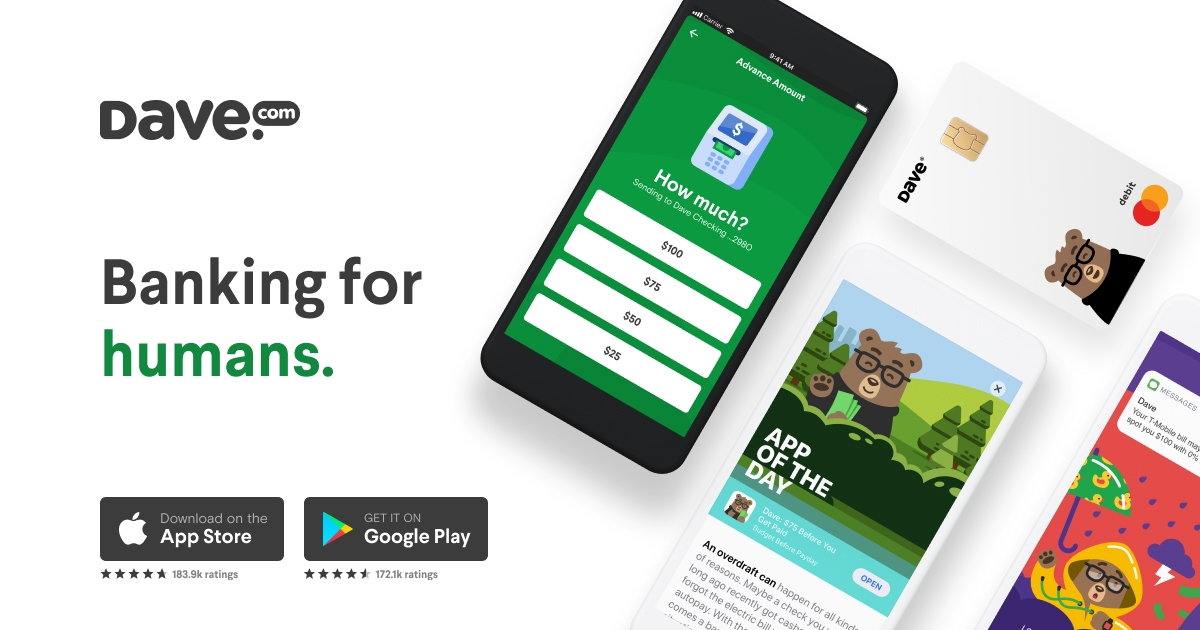

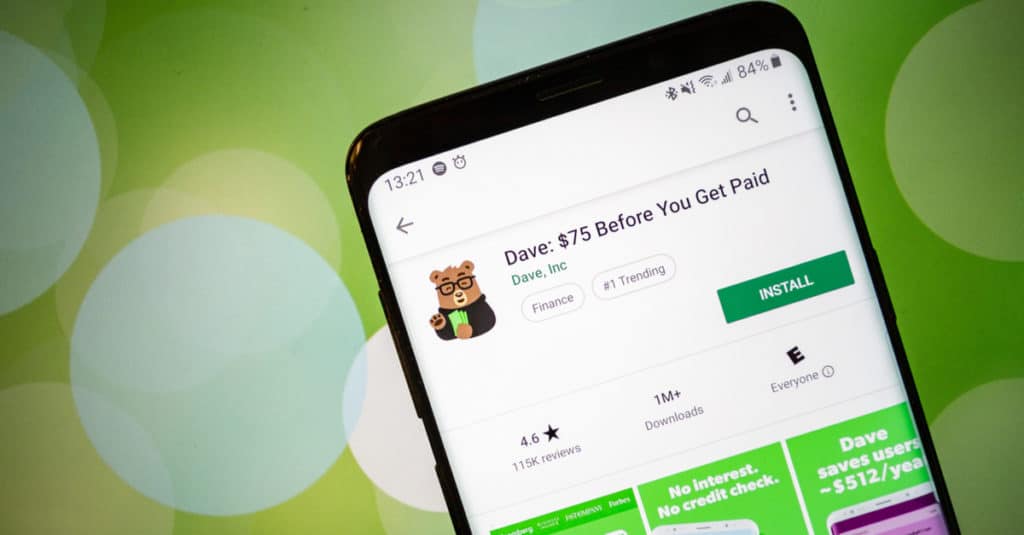

. Dave launched in 2017 with 76 million in funding and another 110 million in a second round. Three friends were fed up with their banking experience often incurring 38 overdraft fees and never having insights into how much money was left before payday. Dave is an awesome tool its primary purpose is an interest free payday loan of up to 100.

Like this post comment below and let me know h. For zero-interest cash advances. This feature is great but my biggest gripe is that the app does not allow you to customize your payday if for example your bank clears your paychecks faster than scheduled.

No interest no credit checks. No credit check required. Essentially the app behaves like Dave it allows you to borrow money depending on the number of hours you already work.

You can earn free credits towards your Dave subscription fee by making debit card. Dave has a subscription fee of just 1 per month so when you consider that an overdraft fee could cost around 35 even if the app only helps you out every once in a while investing in Dave could be well worth it. Easy communication between our bank and yours helps you access money when you need it most.

Thank you for reading and become my Pretti Bestie and engaging with me. Brigit - Brigit also offers free budgeting tools alerts and even cash advances of up to 250 when needed. The dave app charges a monthly fee of 1 but the company claims that it really survives on tips.

For boosting your credit. Well give you an overview of what fetch does all while helping you determine if its a good fit. It offers 100 cash out per day or up to 500 cash out per pay period.

Heres why millions of members use Dave GET UP TO 250 1 Well help you to avoid those pesky charges with cash advances up to 250 for qualified users. From the Dave Ramsey Budget Tool which helps you manage your money create a budget and track your spending to Brigit and Earnin two other money managing apps there are plenty of tools out there. With customer loyalty at big banks at an all time low they figured building the next great financial institution one.

GET PAID 2 DAYS EARLY 2 Get your paycheck up to two days earlier. The app received fairly positive reviews from outlets including Insider with the caveat to be mindful of its tipping system more on this later where users can give a tip to the corporation after putting in the request for an advance. You can also receive money transfer funds and pay bills through Branch.

How do apps like dave and earnin make money. Dave helps you budget for upcoming expenses and alerts you if youre in danger of overdraft. However this app does not charge subscribers a subscription fee.

Dave is a low-cost banking membership app that offers customers fee-free checking as well as up to 75 in interest-free advances. Without all the details of how it makes money while charging such a low monthly fee its reasonable to question whether Dave is merely a rebranded version of the notoriously predatory payday. The budget can help you predict whether youll.

A fee for its instant payment option If you want your money within minutes youll have to pay. The app also comes with no-fee checking a debit card and free ATM access at more than 40000 locations. For high advance amounts.

In addition when you connect your debit card to the Dave app it will automatically create a budget for you. All you do have to pay is your 1month membership fee. Dave securely connects to your external account to help you track your expenses.

Dave does ask for tips for every cash advance you request. For keeping track of finances. Based on Daves pitch and the positive press surrounding its launch its hard not to get the sense that the Dave app may be too good to be true.

Our 6 top picks for apps like Dave. Now that you have made it to the end. And if you need cash fast you can take an advance up to 250 with no-interest.

Using the app costs 1 per month which is deducted from your bank account when your first monthly paycheck hits. It does have a tipping system that allows you to tip Earnin between 1 to 15. Branch charges 299 to 499 for instant external.

The app prompts you to leave an 8 10 or 12. Membership is 1 per month to access our account monitoring notification services budgeting and to maintain.

Dave Banking For Humans On The App Store Banking App Banking Bloomberg Business

Everydollar Explained 13 Tips For Using The Dave Ramsey Budget App Dave Ramsey Budgeting Dave Ramsey Budget App Budget App

Deposit Account Agreement Dave Banking Policies

6 Apps For Your Smartphone That Save Big Money On Groceries Frugal Living Mom Saving Money Coupons Couponing For Beginners

How To Budget Like Dave Ramsey With These Budgeting Percentages Free Budget Dave Ramsey Budgeting Budget Printables

Cash Advance Apps Like Dave Here Are 14 Other Options Debthammer

Cash Advance Apps Like Dave Here Are 14 Other Options Debthammer

Cash Advance Apps Like Dave Here Are 14 Other Options Debthammer

Dave App 2022 Review Paycheck Advances Nerdwallet

Everydollar Free Dave Ramsey Budgeting Software Dave Ramsey Budgeting Budgeting Budget Software

10 Awesome Apps That Make And Save You Money Budgeting Money Money Saving Apps Money Saver

Extra Money Fast Credit Card Application Credit Repair Companies Credit Repair Business

17 Awesome Money Saving Apps Savings Resource Smart Money Money Saving Apps Saving Money Saving

25 Best Dave Ramsey Tips To Manage Your Money Best Money Making Apps Money Saving Apps Dave Ramsey

Free Dave Ramsey Budgeting App Every Dollar Budget App Dave Ramsey Budget App Dave Ramsey Budgeting

Dave Could Be Your New Best Friend When It Comes To Avoiding An Overdraft Things To Come Smart Money Money Matters