fha gift funds cousin

Specify the dollar amount of the gift. The portion of the gift not used to.

Can You Use Gift Funds With Usda Loans

FHA does allow gifts from approved charitable organizations government agency public entity and close friends who have a clearly defined and documented interest in the.

. A close friend with a clearly defined and documented interest in the borrower. The very long standing standard mortgage loan rules require gift money to be from a blood relative or a substantial person with a documented interest in the buyer. FHA loan rules in HUD 40001 have specific guidelines where gift funds to the borrower are concerned.

Gift funds are commonly used for home loan expenses including. Use gift money to pay for the down payment and closing costs. The Federal Housing Administration FHA released a proposed rule earlier this month that would add a 40-year loan modification option to its loss mitigation options.

A gift can be provided by. Gift funds must be. A relative defined as the borrowers spouse child or other dependent or by any other individual who is related to the borrower by.

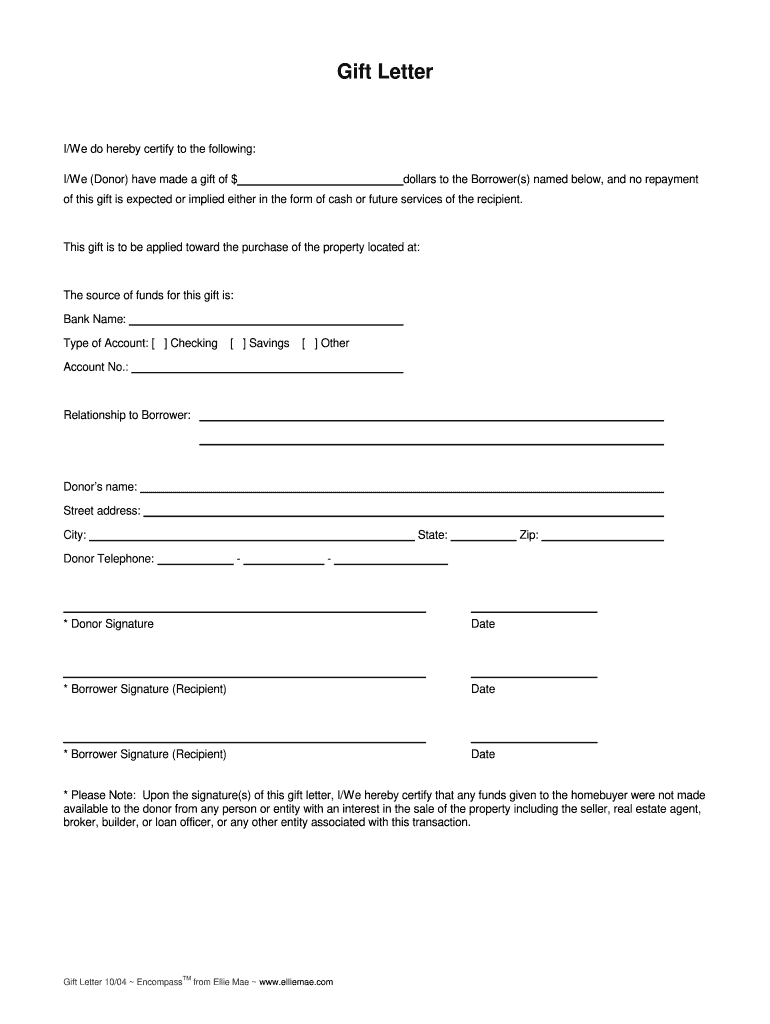

The 203b and 203k only require a 35 percent down payment. If you are applying for a FHA loan the FHA Certification section must be signed by both the gift donor and the recipient acknowledging the warning stated in that section. Gifts must be evidenced by a letter signed by the donor called a gift letter.

If youre buying a multi-family home then you can also use gift funds without contributing any of your own money as long as. The gift letter must. How to Use Gift Funds for Your FHA Mortgage in 2022.

Close friend is very. FHA guidelines for gift funds include. To qualify for an FHA loan you must meet the FHA loan requirements as well as the FHA gift fund guidelines.

The down payment is 20 or more. Gift Funds In order for funds to be considered a gift there must be no expected or implied repayment of the funds to the donor by the borrower. In our last blog post we answered a reader question about whether its acceptable to receive gift funds from a family member for an FHA borrowers down payment.

George Souto NMLS 65149 is a Loan Officer who can assist you with all your FHA CHFA and Conventional mortgage needs in Connecticut. Gift funds must be from an acceptable source such as savings accounts stocks or savings bonds. Provide the donors name address.

The gift letter must. FHA defines this as. The lender is required by the FHA to document any gift funds with a gift letter that is signed by the borrower and donor.

George resides in Middlesex.

Guide To Down Payment Gifts Seattle Mortgage Planners

Fha Gift Letter Template Pleasant In Order To My Own Web Site With This Time Period I Ll Explain To You I Letter Gifts Letter Templates Letter Template Word

Fha Down Payment And Gift Rules Still Apply

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

Down Payment Gift Rules From A Friend Or Relative

Fannie Mae Gift Letter Pdf Fill Online Printable Fillable Blank Pdffiller

Fha Gift Funds Guidelines 2022 Fha Lenders

Fha Loan Rules For Down Payment Gift Funds

Fha Gift Funds Definition And Guidelines Rocket Mortgage

Fha Gift Funds How Can I Use Them To Buy A Home

Fha Gift Letter Template Elegant Gift Letter For Mortgage Letter Gifts Letter Templates Letter Example

Gift Funds When Is A Gift A Gift According To Fha

Mortgage Down Payment Gift Rules Who What Why A Letter

Fha Guidelines On Gift Funds For Down Payment And Closing Costs

What Is A Gift Letter For A Mortgage

A Guide To Gifts Of Equity Rocket Mortgage

Remember When I Used To Blog Regularly Words Inspirational Quotes Great Quotes

Fha Guidelines On Gift Funds For Down Payment And Closing Costs